Federal Tax Brackets 2025 Single

Federal Tax Brackets 2025 Single. This means that these brackets applied to all income earned in 2025, and the tax return that. There are seven federal tax brackets for tax year 2025.

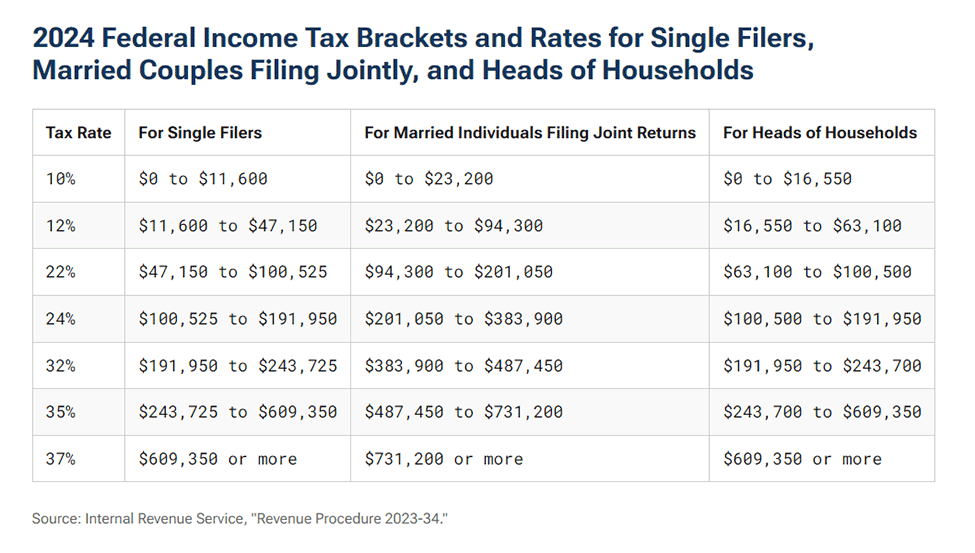

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. New tax brackets for 2025.

Tax Brackets 2025 Single Filers Jeane Lorelle, The rates currently are set at 10%,. Then you’ll pay 12% on all income.

2025 Tax Brackets Single Filer Tool Libby Othilia, There are seven federal tax brackets for tax year 2025. This means that these brackets applied to all income earned in 2025, and the tax return that.

Federal Withholding Tables 2025 Federal Tax, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. You pay tax as a percentage of your income in layers called tax brackets.

Tax Changes for 2025 What You Need to Know Guiding Wealth, About 90 percent of taxpayers now use this deduction. This means that these brackets applied to all income earned in 2025, and the tax return that.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, 10%, 12%, 22%, 24%, 32%, 35% and 37%. The rates currently are set at 10%,.

Tax Rates 2025 To 2025 2025 Printable Calendar, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. There are seven federal tax brackets for tax year 2025.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, 32% for incomes over $191,950; For both 2025 and 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Here are the federal tax brackets for 2025, Federal tax brackets for 2025 the u.s. Here are the rest of the tax brackets for single taxpayers:

2025 Tax Brackets and and Federal Tax Rates pdfFiller Blog, For example, a hypothetical single filer would owe 10% on the first $11,600 of taxable income in 2025 whether that amount represents their total earnings, or they. 32% for incomes over $191,950;

2025 Tax Schedules CA Financial Services, Federal tax rates and brackets. For example, if your taxable income as a single filer is $60,000 in 2025, you’ll pay 10% on the first $11,600 in taxable income.

For the 2025 tax year, taxpayers can deduct $14,600 if they are single and $29,200 if they are married and file jointly.

Best Budget Rice Cooker 2025. We tested 25 leading models—from zojirushi, cuckoo, tiger, and more—to find the best rice cookers[...]

Snl January 20 2025 Cast. Australian actor jacob elordi hosted saturday night live for the first time on january 20,[...]

Ramadan In Usa 2025. In 2025, ramadan will begin on sunday 10 march. Der ramadan (je nach region und sprache[...]